Insurance Brokerage for Dummies

(ANZIIF) Qualified Insurance Policy Expert (CIP) and National Insurance Policy Brokers Association (NIBA) Certified Practicing Insurance Broker (QPIB) credentials.

, or directly by a federal government body., insurance brokers have independent bodies liable for licensing and guideline.

— Cloud here are the findings Links (@ldcloudlinks) top article December 20, 2022

In order to get a broker's license, a person generally needs to take pre-licensing training courses and also pass an examination. An insurance coverage broker additionally have to send an application (with an application fee) to the state insurance coverage regulator in the state in which the applicant desires to do business, who will figure out whether the insurance policy broker has actually met all the state demands and also will generally do a history check to identify whether the candidate is thought about trustworthy and also proficient.

The Single Strategy To Use For Insurance Brokerage

Some states also need candidates to send fingerprints. When accredited, an insurance coverage broker normally need to take continuing education and learning training courses when their licenses reach a revival date. The state of The golden state calls for license renewals every 2 years, which is achieved by finishing proceeding education and learning training courses. Many states have reciprocity contracts where brokers from one state can come to be conveniently licensed in another state.

A state may withdraw, suspend, or refuse to restore an insurance broker's certificate if at any time the state determines (commonly after notification and a hearing) that the broker has actually involved in any type of task that makes him untrustworthy or inexperienced. (CGL) insurance coverage policy that left out protection for the "entertainment service".

Everything about Insurance Brokerage

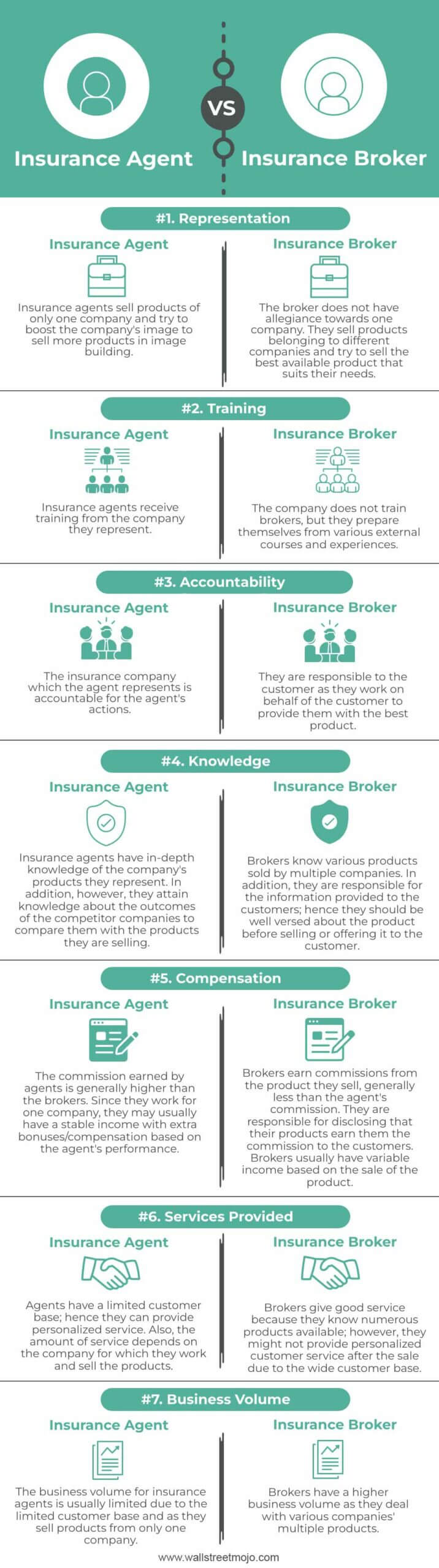

The agent's key alliance is with the insurance coverage carrier, not the insurance customer.

This can have a considerable valuable influence on insurance coverage negotiations gotten with a broker (vs. those acquired from a representative). Any type of person acting as an insurance coverage agent or broker have to be certified to do so by the state or jurisdiction that the individual is operating in. Whereas states formerly would issue different licenses for agents and also brokers, many states currently issue a single producer certificate regardless if the individual is acting on part of the insured or insurance company.

While both agents as well as brokers serve as middlemans between insurance policy buyers and also the insurance market, and also can provide insurance policy quotes on different plans, there are 2 essential distinctions between both: Agents stand for insurance companies, while brokers represent the client. Representatives can complete insurance coverage sales (bind coverage), while brokers can not. While brokers search for plans from multiple different service providers, an agent should offer plans from several of the insurance policy companies that they stand for.

The Main Principles Of Insurance Brokerage

Brokers generally play more of an advisory role in discovering protection than agents, because brokers have a responsibility to represent the finest rate of interests of the customer. Brokers check out numerous plans as well as advise particular insurance coverages from different business, however after that should count on an agent or an insurance policy service provider to have a chosen policy bound to a client - Insurance Brokerage.

When buying insurance, it's smart to obtain quotes from numerous insurance firms to locate the finest cost. While practically anyone can contrast prices on the internet, in many cases it makes feeling to have a specialist stroll you with your options. Easily contrast tailored prices to see how much changing auto insurance coverage could conserve you.

Armed with both your history as well as their insurance expertise, they can discover a plan that finest suits your requirements for a reasonable rate. While brokers can save you money and time, you might have to pay a broker charge for their solutions - Insurance Brokerage. Even with the fee, you may spend much less general.

Insurance Brokerage Things To Know Before You Get This

Required insurance coverage for a business. Wish to look around with several insurance providers without spending your time or energy. Want an individual partnership with somebody purchased knowing your background as well as protection requirements. Bear in mind, if you're buying permanent life insurance policy, it's ideal to speak with a fee-only monetary expert (extra on this later) - Insurance Brokerage.

Comments on “Insurance Brokerage Fundamentals Explained”